Wage growth ticked up in April, good news for American workers but bad news for officials at the Federal Reserve, who have been hoping to see a steady moderation in pay gains as they try to wrestle inflation back under control.

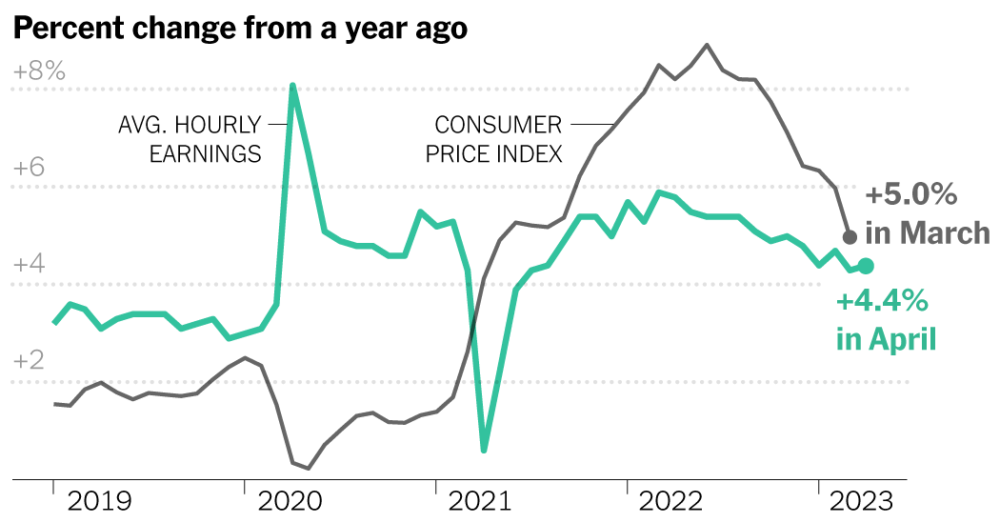

Average hourly earnings climbed by 4.4 percent in the year through April. That compared with 4.3 percent in the previous month, and was more than the 4.2 percent that economists had expected.

The increase in wages compared with the previous month — at 0.5 percent — was the fastest since March 2022.

The hourly earnings measure can bounce around from month to month, so it is possible that the April increase is a blip rather than a reversal in the trend toward cooler wage gains. Even so, the data underscored that the Fed faces a bumpy road as it tries to slow the economy and bring inflation under control.

Fed officials are closely watching the pace of wage growth as they try to assess how quickly inflation is likely to fade. While officials regularly acknowledge that wage gains did not initially cause rapid price increases, they worry that it will prove difficult to return inflation to normal with pay gains rising so rapidly.

Companies may charge more in order to cover their climbing labor costs. And when households are earning more, they are more capable of keeping up with higher expenses without pulling back their spending — enabling businesses to charge more for hotel rooms, child care and restaurant meals without scaring away consumers.

The Fed has raised interest rates at the fastest pace since the 1980s starting from March 2022. Officials this week lifted borrowing costs to just about 5 percent and signaled that they might pause their rate moves as soon as their June meeting, depending on incoming economic data.

Jerome H. Powell, the Fed chair, noted during his news conference this week that wage growth has remained strong. He suggested the solid job market was one reason the Fed would likely keep rates high to continue slowing the economy “for a while” as it tried to wrestle inflation, which remains above 4 percent, back to the central bank’s 2 percent goal.

“Right now, you have a labor market that is still extraordinarily tight,” he said, noting that a more dated wage figure released last week was “a couple percentage points above what would be consistent with 2 percent inflation over time.”

That measure, the Employment Cost Index, showed that wages and salaries for private-sector U.S. workers were up 5.1 percent in March from a year earlier. While that is somewhat faster than the gain reported by the overall average hourly earnings figures for April that were released Friday, it is roughly in line with a closely-watched measure within the monthly jobs report that tracks pay gains for rank and file workers.

Pay for production and nonsupervisory workers — essentially, people who are not managers — climbed by 5 percent in the year through April, Friday’s report showed. That number has continued to gradually moderate, even as the slowdown in the overall index has stalled.

Fed policymakers will have another month of job and wage data in hand before they make their next interest-rate decision on June 14, making Friday’s figures just one of many factors that are likely to inform whether they pause rate increases or press ahead with more policy adjustments. Officials will also have further evidence of how much the recent turmoil in the banking sector is slowing the economy before they next meet.

A series of high-profile bank failures have spooked investors and could generate caution at lenders across the country, which could make it harder to access loans for construction projects and mortgages and help to cool growth — but it is unclear so far how large that effect will be.

Perhaps most importantly, officials will receive fresh inflation data before their next decision.

“They’ll need to see the inflation data and digest this holistically,” said Kathy Bostjancic, chief economist at Nationwide. She said that the strong jobs numbers were just one month of data, but that they were “jarring” to see at a moment when economists had been looking for a slowdown.

“Assuming that the inflation numbers continue to trend lower gradually, I think they can go on hold in June,” she said of the Fed. “But it will depend in the inflation readings.”