Residential real estate investors have historically been a population that has been difficult to identify and measure. The ZG Population Science team recently designed, fielded, and analyzed a survey of this group to better understand who they are and identify potential needs that ZG can address. This brief outlines key characteristics of the landlord population in early 2023.

Median Landlord Has 2 Rental Properties

The typical (median) landlord reported having 2 rental properties. About one in six (16%) reported having 5 or more.

First-time landlords typically have only 1 rental property (56%) – versus repeat landlords who typically have 2. Just under half (47%) of repeat landlords report renting out 3 or more properties – compared to about a quarter (24%) of first-timers. Only 2% of first-time landlords said they have 5 or more rental properties – versus about one in five (20%) repeat landlords.

Typical Landlord Is Older, Higher Income than US Adults as a Whole

The median age of a landlord is 59 years old, and their median household income is $129,870. Both of these trends are higher than US adults – whose median age is 47, and whose typical household income is $70,185. [1]

Landlords are also less likely to identify as people of color than the population of US adults: 78% of landlords are white, versus 62% of US adults.

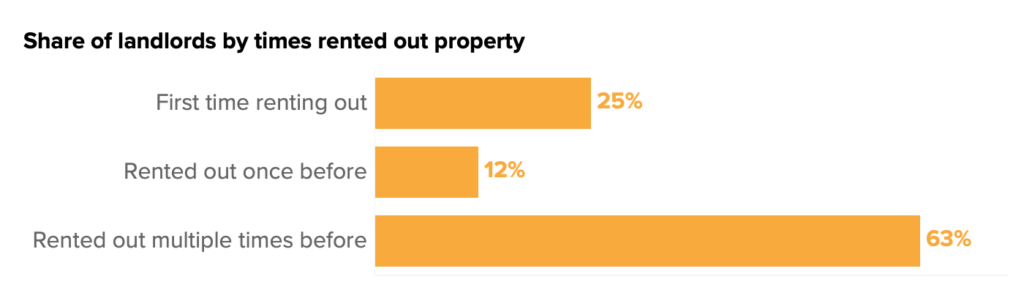

Most Landlords Have Rented Out Previously

Only a quarter (25%) of landlords say they’re renting out their property for the first time. Most (75%) are repeat landlords: 63% have rented out their property multiple times before, and 12% have rented out their property once before.

Single-Family Detached House Is the Most Common Property to Rent Out

Among landlords that only rent out 1 property, 66% rent out a single-family detached house. For landlords that rent out 2 or more properties, the single-family detached house is most common (41%), but apartment/condo in a small building (24%) and duplex/triplex (23%) are also common.

| Type of property/properties rented out | Rent out 1 property | Rent out multiple properties |

|---|---|---|

| Apartment / Condo in a smaller size building (fewer than 10 units) | 10% | 24% |

| Apartment / Condo in a medium size building (10-49 units) | 5% | 16% |

| Apartment / Condo in a larger size building (50 units or more) | 4% | 12% |

| Duplex / Triplex | 6% | 23% |

| Manufactured / mobile home | 5% | 5% |

| Single-family detached house | 66% | 41% |

| Townhouse / rowhouse | 3% | 13% |

Sell or Rent Out?

When deciding to rent out their property, about a third of landlords (36%) said they never considered selling. About a quarter (27%) said they seriously considered selling at least one, and another third (36%) said they thought about selling at least one, but were more serious about renting out.

First-time landlords were more likely to report seriously considering selling (39%) than repeat landlords (24%). Repeat landlords, contrastingly, were more likely to think about selling, but report being more serious about renting out (41%, versus 24% for first-timers).

Findings for landlords contrast with sellers – 47% of whom said they never considered renting out their home instead of selling it. Almost a quarter of sellers (23%) said they seriously considered renting out their home, and 30% said they thought about renting out their home, but were more serious about selling.

When asked why they ultimately decided to rent out their property, landlords were most likely to cite purchasing the property as an investment (56%) as a reason. Two in five (40%) cited wanting to keep their property for a future use, like retirement, vacation home, or a gift to their children. The smallest share (19%) cited renting out as an option to keep the low interest rate on their mortgage.

Time Spent Searching for a New Renter

When landlords encounter a vacancy, they are most likely to report repairs and renovations as their most time-consuming activity: About one in six (17%) estimated spending 11 hours or more per week on them, and 39% reported spending at least 6 hours. Landlords estimated that screening new tenants and giving tours were relatively less time-consuming.

| Estimated time spent per week when searching for a new renter | Screening New Tenants | Scheduling and giving tours | Repairing/renovating the rental |

|---|---|---|---|

| 1 hour or less | 36% | 39% | 27% |

| 2-5 hours | 43% | 35% | 33% |

| 6-10 hours | 15% | 18% | 22% |

| 11 hours or more | 6% | 6% | 17% |

What Landlords Wish They’d Known

About a third of landlords wish they’d known that it’s harder than expected to find reliable renters (36%) and that managing the rental is more time-consuming than expected (36%). A similar share (34%) said that the leasing process is more time-consuming than expected.

| What they say they wish they had known about being a landlord | Total | First-time Landlord | Repeat Landlord |

|---|---|---|---|

| There are more repairs than expected | 31% | 34% | 30% |

| The property is vacant more than expected | 14% | 20% | 12% |

| It’s harder than expected to find reliable renters | 36% | 32% | 37% |

| The leasing process (processing applications, scheduling tours, writing a lease etc.) is more time consuming than expected | 34% | 33% | 34% |

| Managing the rental is more time-consuming than expected (communicating with tenants, accounting etc.) | 36% | 35% | 36% |

| None of the above | 29% | 24% | 30% |

Most Likely to Say Repairs or Maintenance Was Among the Top 3 Most Burdensome Activities

Almost all landlords (92%) said that repairs or maintenance was among the top most burdensome parts of managing their rental property. About 40% considered it the number-one most burdensome.

| Among top 3 most burdensome rental management activities | Total | First-Time | Repeat |

|---|---|---|---|

| Screening tenants (reading applications, doing background checks, credit checks) | 71% | 79% | 68% |

| Scheduling or managing tours with potential tenants | 51% | 60% | 48% |

| Repairs or maintenance | 92% | 88% | 93% |

| Renovations | 51% | 44% | 53% |

| Collecting rent payments | 36% | 28% | 38% |

What Makes a Great Tenant

Largest Share Say Paying the Rent On Time is Most Important

When asked to select the single most important attribute of a great tenant, landlords were most likely to say paying the rent on time (43%), followed by maintaining the home (29%) and having an excellent credit history (14%).

| Most important attribute of a great tenant | |

|---|---|

| Excellent credit history | 14% |

| Good communicator | 7% |

| Maintains the home | 29% |

| Pays rent on time | 43% |

| Quiet/does not disrupt neighbors | 3% |

| Strong references | 4% |

Most Say Tenant(s) With Renter’s Insurance Are “Essential”

Most landlords (56%) said that their tenant(s) having renter’s insurance is “essential” when renting out their property. First-time landlords were especially likely to consider renter’s insurance as essential (65%, versus 53% of repeat landlords).

Methodology

Research Approach

In order to gain a comprehensive understanding of U.S. real estate investors (also known as “landlords”), Zillow Group Population Science conducted a nationally representative survey of more than 1,000 people who own at least one property that they rent out. The study was fielded in February 2023. For the purpose of this study, “real estate investor” and “landlord” refer to people 18 years of age or older who own at least one property that they rent out.

Sampling & Weighting

Results from this survey for real estate investors are nationally representative. To achieve representativeness, ZG Population Science used a two-prong approach. First, the initial recruitment to the sample was balanced to all people ages 18 and up who reported having any rental income in the previous year from the U.S. Census Bureau, 2021 Current Population Survey Annual Social and Economic Supplement (CPS ASEC) on the basis of age, relationship status, income, ethnicity/race, education, region and sex. Additional targeted subgroups were sampled based on all key household demographic characteristics. Second, statistical raking was used to create calibration weights to ensure that the distribution of survey respondents matched the CPS ASEC estimates of the U.S. population with respect to a number of key demographic characteristics. For more information about sampling, weighting, and quality control, email popsci@zillowgroup.com.

[1] Median age and income estimates are from the U.S. Census Bureau Current Population Survey Annual Economic and Social Supplement 2021.