One of Wall Street’s most-vocal bears is seeing signs of softness in corporate earnings that could impede stocks’ ability to continue climbing in 2024.

Michael Wilson, the top U.S. equity strategist at Morgan Stanley, said in a note shared with MarketWatch on Monday that he has doubts about the ability of the biggest U.S.-traded companies to continue expanding their profit margins in 2024 as aggressively as Wall Street analysts expect. That could make it more difficult for companies to meet analysts’ lofty targets for earnings growth.

Signs of waning profit margins have helped inspire analysts to lower their expectations for earnings growth for the quarter already under way.

FactSet data cited by Wilson and others show EPS forecasts for the fourth quarter of 2023 have fallen sharply since the end of September, having declined by 5.3% to $54.81 from $57.86 in aggregate for the S&P 500

SPX.

To be sure, analysts still expect earnings growth of 11.8% for calendar year 2024, which is well above the trailing 10-year average growth rate of 8.4%, Butters said. Analysts have stuck to their forecasts despite economists anticipating the recession that never materialized in 2023 to finally begin sometime next year.

But Wilson has a much more modest view on the prospects for EPS expansion next year. He and his team see growth of just 7%, well below the Wall Street consensus. Ultimately, this could all depend on the rate at which companies can expand their profit margins — if they can be expanded from levels that are already relatively high.

“We also expect a rebound in EPS growth next year (+7%), but are slightly less optimistic in terms of the magnitude of margin expansion (30 bps y/y vs. consensus at 50 bps y/y) as we see earnings risk persisting in the near term before a broader recovery takes hold as next year evolves,” Wilson said in his report.

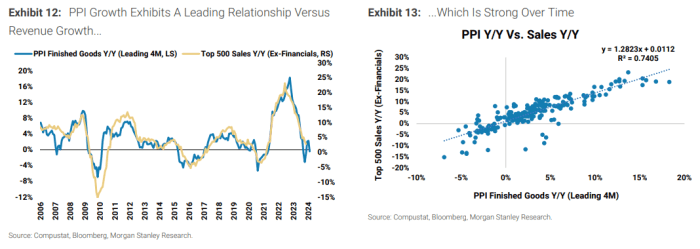

As investors scan for early indicators about how companies might fare next year, Wilson and his team told clients that companies’ ability to boost their sales growth, often necessary for boosting profits, could depend on what happens with wholesale prices.

Historically, the index’s finished-goods component has been a reliable leading indicator for revenue growth among S&P 500 firms.

MORGAN STANLEY

He and his team will be watching Wednesday’s PPI Index report for more clues. The median forecast from economists polled by The Wall Street Journal is calling for growth of just 0.1% in November, compared with a drop of 0.5% in October, which was the largest decline since April 2020.

As Wilson pointed out, profit-margin estimates appear to be driving earnings forecasts.

MORGAN STANLEY

FactSet data show the estimated net profit margin for the S&P 500 this quarter 2023 is 11.2%. That would be below the final reading of 12.2% for the third quarter, and below the five-year average of 11.4% — but equal to the margin from the fourth quarter of last year, when corporations reported negative year-over-year growth in earnings per share.

Things are expected to improve in the new year, however. For 2024, Wall Street analysts expect S&P 500 companies to report a profit margin of 12.3%. If that comes to pass, it would mark the second-highest annual net-profit margin reported by the index since FactSet began tracking the metric in 2008.