Partly cloudy. Low 64F. Winds WNW at 5 to 10 mph..

Partly cloudy. Low 64F. Winds WNW at 5 to 10 mph.

Updated: April 18, 2024 @ 4:30 pm

Source: The Cromford Report

Source: The Cromford Report

Chandler is leading a strong resurgence of the housing market in the Southeast Valley that’s rapidly tilting in favor of sellers, according to a leading Valley analyst.

The Cromford Report, which closely watches the housing market in Maricopa and Pima counties, said last week that its index of market health shows Chandler second among all 17 Valley submarkets it monitors in terms of favoring sellers, behind only Fountain Hills.

Based on a variety of market data, the Cromford Market Index rates municipalities as being balanced at 100 points, with anything over that increasingly tilting toward sellers and anything below favoring buyers. Its latest index puts Chandler at 163 – a 28% increase over its rating a month ago.

That’s bad news for buyers, as it is strangling the modest decline in home prices the market has seen for the last six months, the Cromford Report vartious analysts say.

“The downward pricing trend is weakening because in many places the supply has dropped and demand improved,” the Cromford Report said. “Asking prices are now on the rise and it does not take a big leap of imagination to see closed prices following suit during the second quarter.”

“Overall the market is more favorable to sellers than we expected in December and downward pressure on pricing has been largely eliminated, except in a few market segments,” it said.

Further pointing to a resurgence of the sellers market is an increase in January of listings under contract over December’s numbers.

The Cromford Report said 19 Phoenix Metro ZIP codes showed double-digit increases in listings under contract in January, although none were in Chandler. The closest geographically to northern and western Chandler was Ahwatukee 85245. In all, 10 of 19 were in the city of Phoenix, there were one in Carefree, Glendale, Goodyear and Peoria; two each in Mesa and Gilbert; and one in Sun Lakes.

The number of listings under contract rose from 5,456 in December to 7,810 in January – a 43% increase, it said.

“This is by far the highest percentage increase we have ever measured from one month to the next,” the Cromford Report added. “It shows us that buyers are getting used to interest rates around 6%. It helps a lot when sellers are willing to help them buy down the initial rate.”

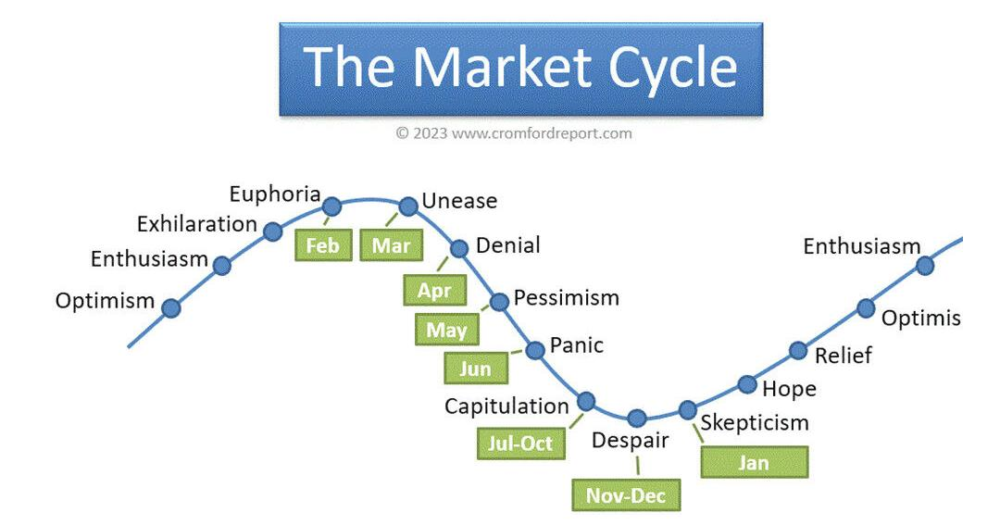

The Cromford Report counseled, “It is time to drop the skepticism and enter the hope stage of the cycle” – a reference to its map of the market cycle, which plots Valley homesellers’ emotional state over the last few years.

“Listings are going under contract so quickly that the supply of new listings cannot keep up, despite a much higher flow of new listings than we saw in December,” it said.

“We are heading back towards a supply-constrained market and it is likely that prices will start to move higher within a short space of time. Asking prices are moving upwards quickly and these are usually a leading indicator.

“While there is no guarantee that mortgage rates won’t go higher again, 2023 has started out much stronger than anyone expected back in November.”

The Cromford Report also said that overall, January closings totaling 4,559 were 44% below those record in January 2022, with new home sales down by 6% and resales plummeting 49%. The monthly media price of those sales last month was $439,000 – down less than 1% from a year earlier.

The median sales price of new homes sold last month was $503,195 – up 9.4% over January 2022 – while the median sale price of re-sale homes was down 4.3% in the same period to $420,000.

It also noted, “Although closed sales volumes are low and prices are down from this time last year, total dollar volume is higher than it was in February 2020, just three years ago. This is because prices are so much higher than they were on 2020.”

All this good news for sellers also became a springboard for the Cromford Report to take a shot at Wall Street giant Goldman Sachs for its fear-inspiring forecast – and some media outlets, notably Fox News, for giving it more credence than Cromford thinks is warranted.

It ripped Goldman Sachs for “making all kinds of weird and unlikely forecast” that said the housing market would crash and home values plummet by as much as 25% or more in four cities, including Phoenix.

“Not quite sure how to deal with it because its description of the current Phoenix market bears little comparison with the real world,” the Cromford Report said.

“The idea that interest rates will skyrocket in 2023 seems more than a little far-fetched when the inflation rate is falling,” Cromford said. “It could happen, but to have this as your base case seems very irresponsible.

“Is Goldman Sachs really saying Phoenix home prices will go up and then drastically down? Come on now, there is no data that supports that outlook. Just a wild-ass guess?”

Noting home values crashed by 60% between 2006 and 2011 in the Valley during the Great Recession, the Cromford Report slammed Goldman Sachs for using that for comparison. “Since the peak in May 2022 of $475,000, the median was down to $412,000 by December. This is a fall of 13% so far,” it said.

While wondering whether Fox News “garbled the message that Goldman Sachs put out,” it called out Goldman Sachs s well for forecasting mortgage rates months from now, stating, “No one has ever been very good at forecasting mortgage interest rates more than a couple of weeks in advance.

“This includes the Mortgage Bankers Association and it especially includes Goldman Sachs whose track-record on interest rate forecasts is extremely poor,” the Cromford Report continued.

“This is not saying much because there is no one who gets them right more than by random chance.Any time spent listening to people making interest rate forecasts is time you could have spent more productively.”

Never miss an issue. Sign up for free today.

Your browser is out of date and potentially vulnerable to security risks.

We recommend switching to one of the following browsers: