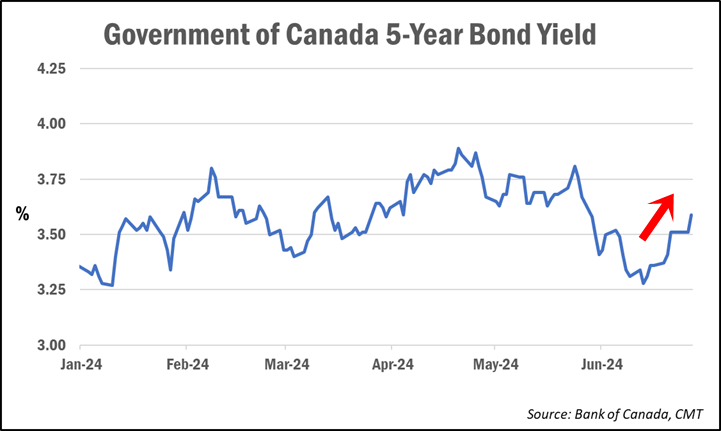

After being on a downward path for the past two months, Canadian bond yields have reversed course and are once again on the rise.

After reaching their lowest point of the year last month, Government of Canada bond yields, which influence fixed mortgage rates, have surged more than 30 basis points, or 0.30%.

As of Tuesday, the 5-year GoC bond yield—which moves inversely to bond prices—broke back above 3.60%, a two-week high. And in the U.S., the 10-year Treasury yield similarly rose to its highest point since mid-June.

Why are bond yields rising?

While slowing inflation rates in both Canada and the U.S. had helped drive down yields in recent months, several factors are behind this latest turnaround, experts say.

For one, U.S. President Joe Biden’s poor performance during last week’s presidential debate may be leading investors to anticipate a higher chance of former President Donald Trump winning the November presidential election, adding more pressure on Treasuries.

“For a variety of reasons having to do with fiscal policy, tariff policy, and immigration policy, we do believe that a prospective Trump administration in 2025-2028 will be more inflationary than a Biden administration,” Thierry Wizman, a global forex & rates strategist at Macquarie Group, was quoted as saying in the Economic Times.

Additionally, comments by Federal Reserve Chair Jerome Powell on Tuesday seemed to support a potentially “higher-for-longer” interest rate outlook.

While he expressed satisfaction with the progress on inflation over the past year, Powell said he wants to see more before being confident enough to start cutting interest rates. “We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy,” he said.

As we’ve reported on in the past, Canadian bond yields, and in turn mortgage rates to a degree, largely take their cue from economic conditions and developments south of the border.

How could fixed mortgage rates be impacted?

After seeing some substantial reductions in fixed mortgage rates over the past few weeks, some rate watchers say borrowers should expect those cuts to pause for now.

“Definitely, the [rate] drops will stop, but if we see the bond yield hit 3.60% and hold, I would think you would see at least the uninsurable creep up a bit,” rate expert Ryan Sims told CMT. “You would also kiss goodbye to the deep-discounted insured 5-year rates at that point, although I could see the 4.89% fixed hang around for insurable.”

However, rate shoppers could also see some rates start to rise again as well, says Ron Butler of Butler Mortgage.

“Rates are going up as I type this,” he told CMT, adding that the big banks are being “less aggressive” in their discretionary pricing.

“The ultimate trend [for fixed mortgage rates] will be down, but it won’t be linear,” Butler added.

So, what would it take to get bond yields—and mortgage rates—back on a downward path?

“We would need to see inflation come way down in order to bring rates down,” Sims says. “Every month we see inflation hang higher than anticipated, we push bond yields up.”

For now, it could take some more time for inflation to edge back towards the Bank of Canada’s desired 2% neutral target. In May, Canada’s headline inflation rate rose back to 2.9% from 2.7% in April.

BMO chief economist Douglas Porter described inflation as being on a “bumpy” path going forward.

This is also likely to delay rate relief for variable-rate mortgage borrowers, whose rates are directly correlated to the Bank of Canada’s monetary policy decisions. While markets had previously expected a second quarter-point rate cut from the central bank at its upcoming July meeting, forecasts are now suggesting a September rate cut is more likely.

The other economic indicator experts are watching will be this week’s release of employment data in both Canada and the U.S.

“The market consensus is for a continued rise in our unemployment rate to 6.3%,” Bruno Valko, VP of national sales for RMG, wrote in a note to subscribers. “In my opinion, we desperately need relief in the form of lower interest rates.”