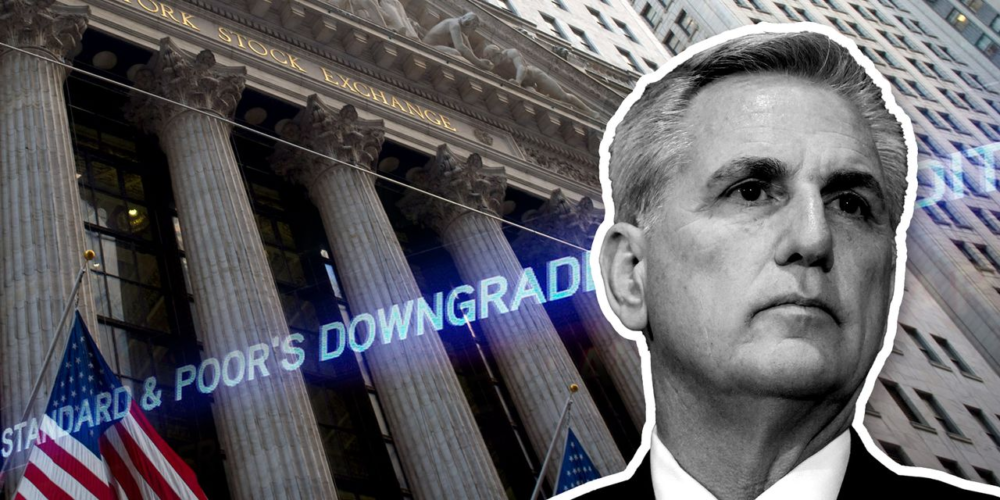

House Speaker Kevin McCarthy is set to make a fresh move in Washington’s standoff over the U.S. debt limit, as the California Republican is expected to deliver a speech on the issue around 10 a.m. Eastern Monday at the New York Stock Exchange.

For months, McCarthy and his fellow Republicans have called for spending cuts in exchange for raising the ceiling for federal borrowing, while President Joe Biden and his fellow Democrats have said the lift should be made without preconditions.

The speaker is coming to the NYSE to get Wall Street on his side, but it’s a tricky maneuver that might not work that well, according to analysts at Height Capital Markets.

“We suspect that McCarthy’s speech is designed to rally financial players to pressure the administration to the negotiating table on spending. However, this does exacerbate the risk that the speaker will startle investors more than he intends, in our view,” said Benjamin Salisbury, Height’s director of research, in a note Friday.

The Treasury Department said in January that it had started to use “extraordinary measures” because the federal government was running up against its ceiling for borrowing. The Bipartisan Policy Center has estimated that the “X date” — the day when the government can’t meet all obligations — likely will arrive in the summer or early fall, with the exact timing depending heavily on 2022 tax collections that are hitting their peak this month, as Tax Day this year falls on this coming Tuesday.

In August 2011, lawmakers approved an increase to the debt limit just hours before a potential government default. Within days, the U.S. then lost its triple-A debt rating from Standard & Poor’s for the first time in history, with the credit-rating agency saying the American political system had become less stable. Stocks

SPX,

DJIA,

plunged in August 2011 following the downgrade from S&P.

This year’s standoff over the debt limit is likely to weigh on markets, but there are “very, very low odds of default” and “worst-case outcomes.” according to 22V Research’s Kim Wallace.

“My guess is that sometime beginning Memorial Day the parties will begin to circle around each other and eventually negotiations will be engaged on fiscal year ’24,” said Wallace, 22V’s head of Washington policy research, in a recent interview with MarketWatch.

“The question will remain, and it will vex markets and anyone else who pays attention between now and late summer or fourth quarter,” he added. “It will vex you in terms of the process and how they get there, but very much more than likely they’ll get there. It’ll be loud, messy, probably displeasing for most stakeholders and participants, but they’ll get there.”

Ahead of McCarthy’s speech, the speaker and other top Republicans have developed a tentative proposal that calls for a House vote in late May to suspend the debt limit for a year, according to multiple published reports.

In exchange for that vote, there would be a cap on non-defense discretionary spending or a cap on overall discretionary spending after reducing it to levels hit in the 2022 fiscal year, along with other GOP-favored measures. That’s according to a Punchbowl News report.

The tentative proposal has “some good stuff,” said Brian Riedl, a senior fellow at the Manhattan Institute, a conservative think tank, in a tweet Thursday.

“Obviously, this may not pass the House and certainly not the Senate. But as a starting point, this package is more reasonable and harder to demagogue than where we were 2 months ago. Some smaller piece of this may make it over the finish line (but not until the last minute),” Riedl also said.