As the real estate market continues to recover from the pandemic, many investors are thinking about the best property investment locations.

Table of Contents

- Property Investment Locations That Are Generally Popular in the US

- 5 Best Property Investment Locations for Long Term Rentals

- 5 Best Property Investment Locations for Short Term Rentals

- How to Find the Best Locations for Property Investments

With so many options available, choosing the right location is important to ensure maximum return on investment.

Moreover, when considering where to invest, it’s crucial to consider factors such as the job market, cost of living, quality of life, and growth potential. By investing in the right location, you can ensure maximum return on your investment and secure your financial future.

In this article, we’ll discuss some of the best property investment locations in the US in 2023 and how to locate them using Mashvisor’s new Market Finder tool.

Related: 5 Best Ways to Invest in Real Estate in 2023

Property Investment Locations That Are Generally Popular in the US

Before we dive deep into the specific best places to buy rental property based on data that Mashvisor provides, let’s see some of the standard and popular locations in the US.

1. Austin, TX

The Austin real estate market is heating up, with some property prices nearly tripling in the last decade. Austin’s population is rapidly expanding, ranking first among large cities in the US.

In addition, for many years, tech firms from California’s famed Silicon Valley were relocating to Austin. Nonetheless, the city’s expansion can be attributed also to movers seeking affordable housing prices and median rents.

Austin also boasts a 4.2% unemployment rate, much lower than the national average. The low unemployment rate, along with limited supply, strong rental demand, rising prices, and a thriving employment market, are helping boost housing in the city.

2. Raleigh, NC

Because of the large student population, around 43% of Raleigh residents rent rather than purchase. The figure is roughly 10% greater than the national average of approximately 33%. Because of the significant rental demand, Raleigh is also a center for lucrative rental ventures.

Another element of the city that makes it a desirable real estate investment is the income-to-unemployment ratio. Raleigh boasts a far lower unemployment rate and an average yearly income that is higher than the national average.

3. Denver, CO

Denver in Colorado is another swiftly expanding location with a rising population, living costs, and rental rates. It is also an excellent place for rental investors, with 51% of houses in the city inhabited by renters.

The consistent growth in the city’s rental market can be attributed to a thriving economy and expanding job market. Tourism is also robust, resulting in substantial profits, particularly in the vacation rental sector.

4. Columbus, OH

Columbus remains a popular location for young families due to its inexpensive cost of living and diverse population.

Apart from appealing to young families, it is also enticing to real estate investors. It is because of its cheap housing prices and low rent-to-income ratio, which make Columbus’s investments particularly appealing.

Nevertheless, such cheap housing prices will not last forever. Housing prices in Columbus are up 8.4% in the last year alone. The growth in housing prices and the consistent population increase in recent years have strengthened the Columbus housing market.

5. Tampa, FL

Tampa is a seaside city that’s long been a favorite retirement and snowbird resort. The city’s also become a popular destination for young workers and their families in recent years. It features a low cost of living, a healthy employment market, and a good standard of living. Furthermore, Tampa’s real estate market remains strong, with home values gradually growing.

According to Zillow, the price of a house rose by around 27.7% in the past year. It is a significant shift, especially given the 1.4% growth in population. Similarly, Tampa saw a 39% surge in rental prices.

The said growth rates are significantly higher than the national average. It’s the main reason Tampa is on our list of the top areas to buy a rental property.

Related: 20 Best Places to Invest in Real Estate in Florida in 2023

5 Best Property Investment Locations for Long Term Rentals

Below, you can see the best property investment locations for long term rentals based on Mashvisor’s data from March 2023. In addition, we listed the following locations based on the following:

- The median property price is below $1 million

- With at least 100 traditional listings

- Long term rental income is above $2,000

- Highest long term rental cash on cash returns

- Price to rent ratio is at least 20

1. North Miami, FL

- Median Property Price: $858,896

- Average Price per Square Foot: $486

- Days on Market: 150

- Number of Long Term Rental Listings: 315

- Monthly Long Term Rental Income: $3,399

- Long Term Rental Cash on Cash Return: 4.33%

- Long Term Rental Cap Rate: 4.40%

- Price to Rent Ratio: 21

- Walk Score: 52

2. Stuart, FL

- Median Property Price: $754,015

- Average Price per Square Foot: $387

- Days on Market: 78

- Number of Long Term Rental Listings: 412

- Monthly Long Term Rental Income: $3,010

- Long Term Rental Cash on Cash Return: 3.42%

- Long Term Rental Cap Rate: 3.46%

- Price to Rent Ratio: 21

- Walk Score: 46

3. Virginia Beach, VA

- Median Property Price: $506,109

- Average Price per Square Foot: $323

- Days on Market: 50

- Number of Long Term Rental Listings: 1,767

- Monthly Long Term Rental Income: $2,089

- Long Term Rental Cash on Cash Return: 3.34%

- Long Term Rental Cap Rate: 3.39%

- Price to Rent Ratio: 20

- Walk Score: 21

4. Palm Beach Gardens, FL

- Median Property Price: $1,018,166

- Average Price per Square Foot: $452

- Days on Market: 73

- Number of Long Term Rental Listings: 736

- Monthly Long Term Rental Income: $4,122

- Long Term Rental Cash on Cash Return: 3.33%

- Long Term Rental Cap Rate: 3.37%

- Price to Rent Ratio: 21

- Walk Score: 2

5. Winter Park, FL

- Median Property Price: $858,436

- Average Price per Square Foot: $406

- Days on Market: 124

- Number of Long Term Rental Listings: 176

- Monthly Long Term Rental Income: $2,964

- Long Term Rental Cash on Cash Return: 3.30%

- Long Term Rental Cap Rate: 3.35%

- Price to Rent Ratio: 24

- Walk Score: 25

Are you ready to find the ideal investment property for you? Start searching for investment property hotspots for long term rentals now.

5 Best Property Investment Locations for Short Term Rentals

In the section below, you can see the best property investment locations for short term rentals based on Mashvisor’s data from March 2023. In addition, we listed the following locations based on the following:

- The median property price is below $1 million

- With at least 100 active listings on the short term rental market

- With at least $2,000 in monthly rental income

- Highest short term rental cash on cash returns

- With an occupancy rate of 50% and above

1. Northlake, IL

- Median Property Price: $323,180

- Average Price per Square Foot: $217

- Days on Market: 139

- Number of Airbnb Listings: 120

- Monthly Airbnb Rental Income: $4,269

- Airbnb Cash on Cash Return: 8.29%

- Airbnb Cap Rate: 8.44%

- Airbnb Daily Rate: $171

- Airbnb Occupancy Rate: 53%

- Walk Score: 33

2. Columbia Heights, MN

- Median Property Price: $294,482

- Average Price per Square Foot: $142

- Days on Market: 22

- Number of Airbnb Listings: 314

- Monthly Airbnb Rental Income: $3,724

- Airbnb Cash on Cash Return: 8.06%

- Airbnb Cap Rate: 8.21%

- Airbnb Daily Rate: $158

- Airbnb Occupancy Rate: 58%

- Walk Score: 82

3. Greenfield, PA

- Median Property Price: $255,400

- Average Price per Square Foot: N/A

- Days on Market: 92

- Number of Airbnb Listings: 1,201

- Monthly Airbnb Rental Income: $3,027

- Airbnb Cash on Cash Return: 7.74%

- Airbnb Cap Rate: 7.90%

- Airbnb Daily Rate: $150

- Airbnb Occupancy Rate: 53%

- Walk Score: 64

4. Penn Hills, PA

- Median Property Price: $221,839

- Average Price per Square Foot: N/A

- Days on Market: 97

- Number of Airbnb Listings: 101

- Monthly Airbnb Rental Income: $2,818

- Airbnb Cash on Cash Return: 7.73%

- Airbnb Cap Rate: 7.91%

- Airbnb Daily Rate: $155

- Airbnb Occupancy Rate: 54%

- Walk Score: 43

5. Bridgeton, MO

- Median Property Price: $264,711

- Average Price per Square Foot: $136

- Days on Market: 23

- Number of Airbnb Listings: 120

- Monthly Airbnb Rental Income: $3,291

- Airbnb Cash on Cash Return: 7.69%

- Airbnb Cap Rate: 7.83%

- Airbnb Daily Rate: $154

- Airbnb Occupancy Rate: 58%

- Walk Score: 3

If you wish to find the most lucrative investment property, start searching for investment property hotspots for short term rentals today.

How to Find the Best Locations for Property Investments

Choosing the correct location is vital if you’re considering investing in real estate. It might mean the difference between your investment’s success and failure.

Investing in real estate in 2023 can be a terrific way to make money, but it comes with obstacles. Finding the perfect location for investment property is one of the most challenging tasks. When investing in a property, it is crucial to research the local market and grasp the profit potential properly.

We’ll outline a step-by-step guide on how to find the best locations for property investments.

Step 1: Define Your Investment Goals and Criteria

As an investor, you will need to put in additional hours of research and analysis to ensure you obtain the proper knowledge and data to make an informed investment decision. To achieve a deeper understanding of a market, you must either visit it in person or interact with a local real estate agent or investor.

Setting your investment goals and criteria before exploring possible investment areas is critical. It will assist you in narrowing your search and focusing on areas that fit your requirements. Assess your budget, investment timeframe, expected return on investment, and risk tolerance.

Step 2: Research Real Estate Market Trends

Research real estate market trends once you’ve determined your investing goals and requirements. Examine previous and present local real estate market patterns, such as property valuations, vacancy rates, and rental rates. The said data will assist you in identifying locations where demand is strong and supply is lower.

Related: 3 Interesting Real Estate Market Trends to Expect in 2023

How Mashvisor’s Market Finder Tool Can Help

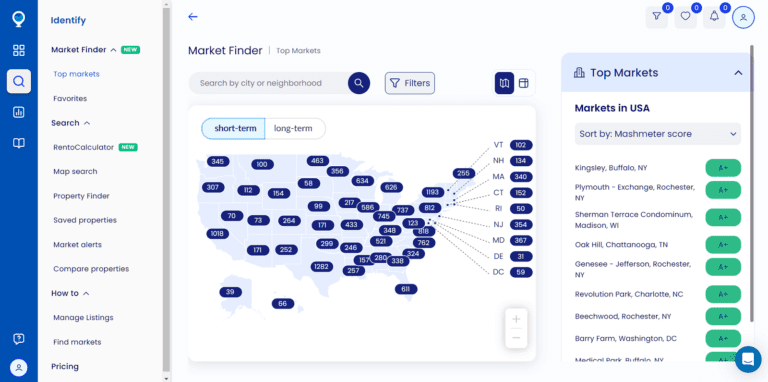

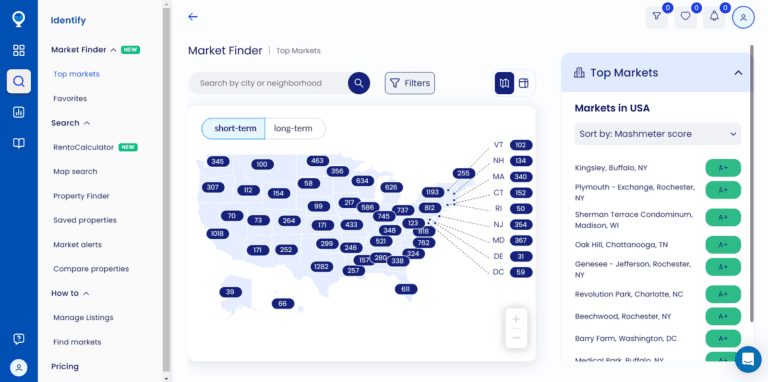

Mashvisor’s Market Finder tool is a helpful tool for property investors in locating the best areas for their investments. The tool examines real estate markets in the US, employing data-driven analytics to find prospective investment possibilities.

Below, we’ve listed some of the ways in which Mashvisor’s Market Finder tool can help property investors:

- Identify top markets: Based on parameters such as property valuations, rental rates, and vacancy rates, the software generates a list of top-performing real estate markets.

- Analyze neighborhoods: The tool enables investors to examine individual areas within a market, offering information on critical variables such as average rental income, occupancy rates, and cash flow possibilities.

- Evaluate investment properties: It gives specific information on particular investment properties, such as anticipated rental revenue, operating costs, and returns.

- Monitor real estate trends: The tool delivers real-time market data on changes in property valuations, rental rates, and vacancy rates.

- Save time and effort: Mashvisor’s Market Finder tool helps investors save time, so they no longer need to conduct extensive research and evaluation on their own.

Mashvisor’s Market Finder helps real estate investors locate the best areas for their investments by using data-driven analytics.

Step 3: Consider Economic and Demographic Factors

Demographic and economic considerations can also be important in identifying the best locations for real estate investments. Consider things like employment growth, growing population, and median income. Always choose areas with a robust and developing local economy and a regular flow of potential renters or purchasers.

Step 4: Evaluate Local Infrastructure and Amenities

It is critical to examine the local infrastructure and facilities while analyzing possible investment locations. Check out the public transit, schools, hospitals, retail malls, and recreational locations. Properties in communities with adequate infrastructure and facilities are more likely to be appealing to potential renters or buyers.

Step 5: Check for Regulatory Restrictions and Zoning Laws

Search for regulatory limits and zoning rules before investing in a property. Examine local rules and limits that may affect your investment, such as construction codes, zoning laws, and rental requirements. They will assist you in avoiding costly mistakes and ensuring that your venture is legally compliant.

Step 6: Seek Expert Advice

Lastly, while analyzing possible investment locations, seek professional guidance. Speak with a local real estate agent or investment adviser who knows the market and can offer important insights and recommendations.

Additionally, consider attending real estate seminars and workshops and networking with other real estate investors to gain valuable insights and knowledge.

Find the most profitable real estate investments using our 7-day free trial of Mashvisor’s Market Finder.

Conclusion

Finding the best property investment locations requires careful research, analysis, and consideration of various factors.

By defining your investment goals, researching real estate market trends, and considering economic and demographic factors, you can identify potential investment locations. Also, make sure to evaluate local infrastructure and amenities, check the regulatory restrictions and zoning laws, and seek expert advice. Doing so will surely help to find investment locations that offer the best return on investment.

In addition, when considering where to invest, it’s crucial to consider factors such as the job market, cost of living, quality of life, and growth potential. By investing in the right location, you can generate substantial income over the years and secure your financial future.

Mashvisor offers a suite of tools and services that can help long term and short term investors identify profitable locations and manage their rental properties more effectively. Specifically, its Market Finder tool helps identify the hottest US real estate markets, optimize pricing strategies, and maximize rental income.

Start your investment journey with Mashvisor by making the most of our 7-day free trial.