Our research team releases regular monthly housing trends reports. These reports break down inventory metrics like the number of active listings and the pace of the market. In addition, we continue to give readers more timely weekly updates, an effort that began in response to the rapid changes in the economy and housing as a result of the COVID-19 pandemic. Generally, you can look forward to a Weekly Housing Trends View and the latest weekly housing data on Thursdays with a weekly video update from our economists on Fridays. Here’s what the housing market looked like over the last week.

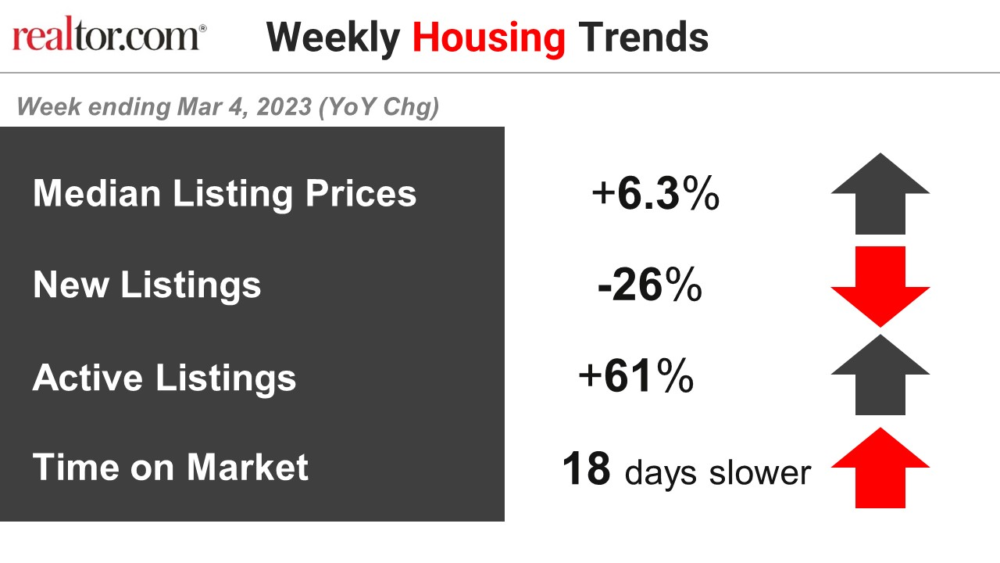

Housing market indicators continued to be stable this week. Both home price growth and the change in the time a typical listing spends on the market matched last week’s pace, while inventory rose more slowly as newly listed homes declined.

For the past several weeks, the housing market has remained in limbo as all eyes have been on the pace of inflation, the stability of the financial system, and the actions the Federal Reserve has chosen to balance the two. The Federal Reserve Board decided to moderately increase rates by 25 basis points following their Federal Open Market Committee (FOMC) meeting on March 22nd and noted that tighter credit conditions in the banking sector could also act as a substitute for rate hikes, potentially limiting the need for ongoing monetary policy response. Nevertheless, economic conditions will keep upward pressure on rates and downward pressure on credit accessibility in the near-term, which will continue to present an affordability challenge for buyers and may keep some sellers, who are locked in at lower rates, waiting on the sidelines.

Key Findings:

Growth in the typical asking price of for-sale homes continued to hold steady, again matching last week’s pace for the third week in a row, at 6.3% year-over-year. This remains to be the lowest sales price growth rate since June 2020. Prior to the financial sector uncertainty caused by recent bank failures, the market was on-track to respond to gradually rising mortgage rates with gradually softening home listing prices. At this week’s FOMC meeting, the Federal Reserve Board decided to moderately increase the short-term policy rate by 25 basis points and noted that reduced credit accessibility due to recent banking sector instability could also help achieve the target inflation rate. This signals that their tightening campaign could be starting to wind down. Nevertheless, rates are expected to remain elevated in the near term, which implies that home prices may continue to soften this spring season.

For 37 weeks, fewer homeowners put their homes on the market for sale than at the same time a year prior. This week’s gap was larger than last week’s, and the lack of new sellers continues to be a drag on existing home sales, which declined by 22.8% compared to February of last year, according to the National Association of Realtors. Moreover, sentiment toward housing and selling sentiment in particular worsened in February, as fewer consumers expect home prices to increase over the next year. This low consumer sentiment and increased economic uncertainty could mean that fewer homeowners decide to sell compared to last year in the spring homebuying season.

Inventories of for-sale homes rose, but at a slightly slower pace than last week’s gain, as new sellers on the market held back more. With a lack of newly listed homes compared to the same time last year, growth in the number of homes for sale is driven by longer time on market. However, it is important to note that this time last year, time on market was near all-time lows. In February, despite the increase in time spent on the market, the inventory of homes for sale was still 47% below pre-pandemic levels.

For 33 weeks, homes on the market have been for-sale longer than was typical one year ago. This week marked the third week in a row where the gap remained at 18 days, with the difference from last year steadying after several weeks of shrinking during a time when mortgage rates looked to be decreasing. So far the usual seasonal pick-up in the pace of home sales seen in the spring time is continuing this year as we approach the Best Time to Sell a home which typically falls in April.

Data Summary:

Note: With the release of its Weekly Housing Trends Views-Data Week Ending in Feb.18 2023 , Realtor.com® incorporated a new and improved methodology for capturing and reporting housing inventory trends and metrics. The new methodology updates and improves the calculation of time on market and improves handling of duplicate listings. Most areas across the country will see minor changes with a smaller handful of areas seeing larger updates. As a result of these changes, the weekly data released since February 23, 2023 will not be directly comparable with previous data releases (files downloaded before February 23, 2023) and Realtor.com® economics blog posts. However, future data releases, including historical data, will consistently apply the new methodology.

Subscribe to our mailing list to receive monthly updates and notifications on the latest data and research.

Join our mailing list to receive the latest data and research.

Weekly Housing Trends View — Data Week Ending Mar 18, 2023 – Realtor.com News

(Visited 2 times, 1 visits today)