Price and population peaks in various markets coincided.

Home prices go with the flow. The flow of population, that is. We could also call this Twin Peaks because the height of the recent home price boom seems to be a twin of the height of population growth.

The boom sprang from the special circumstances of the pandemic when nobody wanted to sell their house, but a few people very much wanted to buy one. In this very thin market, prices were quickly bid up, prompting more buyers to jump in before prices rose even more. The cycle created a classic boom of epic proportions.

The boom sprang from the special circumstances of the pandemic when nobody wanted to sell their house, but a few people very much wanted to buy one. In this very thin market, prices were quickly bid up, prompting more buyers to jump in before prices rose even more. The cycle created a classic boom of epic proportions.

What happens now? Prices will come down. It’s as simple as that. Although prices are already lower in some markets, they remain strong in places such as Florida and South Carolina. When will those prices soften? It’s largely a matter of timing.

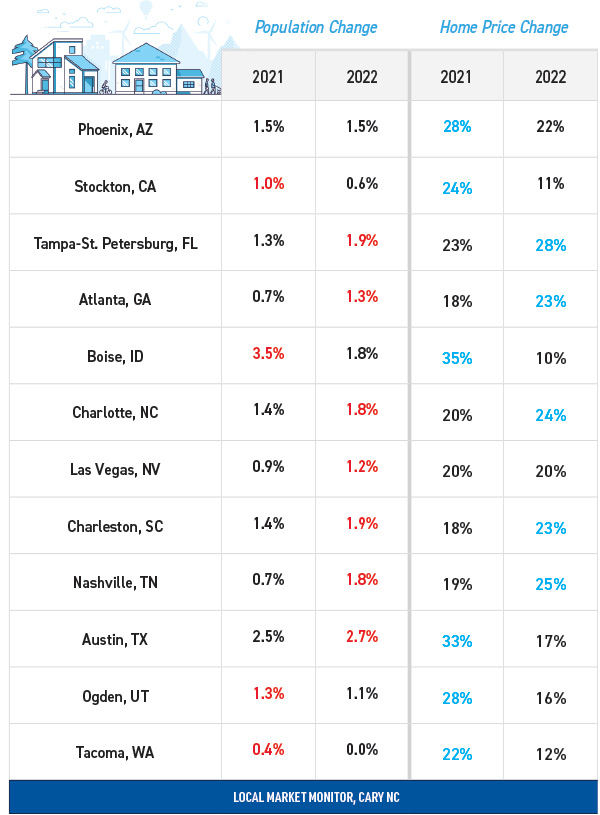

The table shows the percentage change in population and home prices during the boom for a dozen markets around the country. The year population rose the most and the year home prices rose the most are highlighted.

With the exception of Austin and maybe Phoenix, the pattern is clear. The peak of the price change occurs in the year of strongest population growth. Even strong population growth can’t keep prices high, however. Just look at Boise and Austin, where prices increased much less in 2022 (and will be lower in 2023), despite high population growth.

When home prices in any market increase 40% in two years, they’ll come down again; there just aren’t enough buyers to support those prices (meanwhile, builders are increasing the supply as fast as they can). Now that the cause of the boom has disappeared, it’s just a matter of time and timing.