It’s earnings season and options expiration week for the month of April.

Both of those items have historically been extremely bullish: stocks almost always rally into earnings and options expiration week is the week of for Wall Street to gun the markets higher.

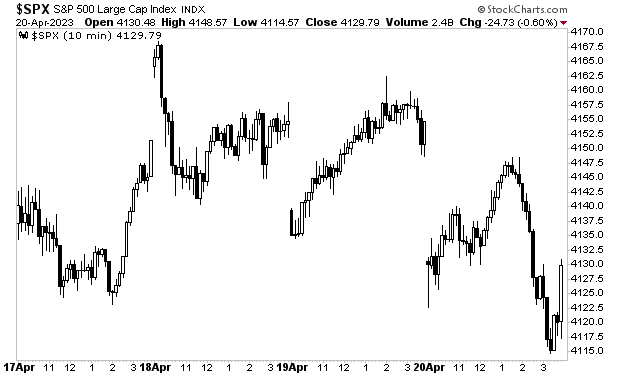

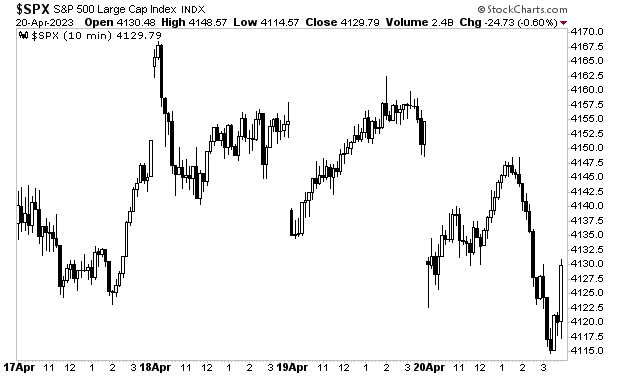

And yet… the stock market is doing this.

When a pattern that has a lot of historical precedent stops working… it can indicate a serious shift is taking place under the surface of the markets.

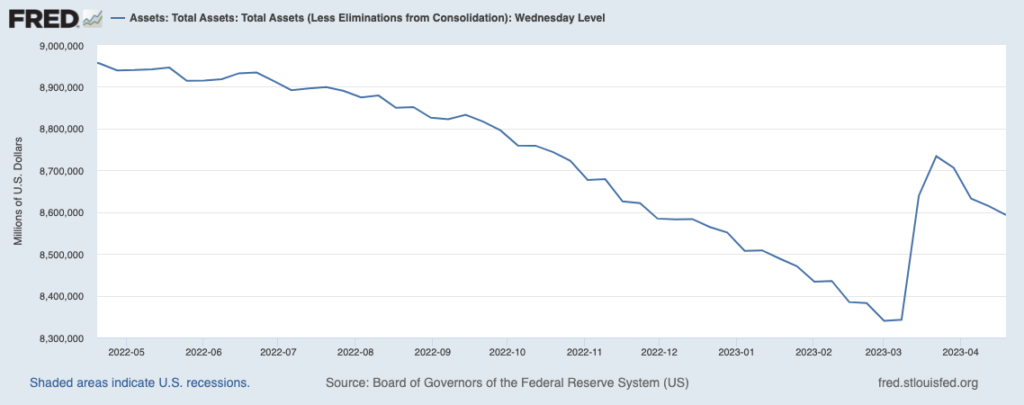

I would also note that the Fed’s balance sheet has rolled over, indicating that the Fed is withdrawing liquidity from the system again.

While Bitcoin and other liquidity plays are beginning to roll over as well.

All of this suggests the next leg down for the markets is just around the corner.