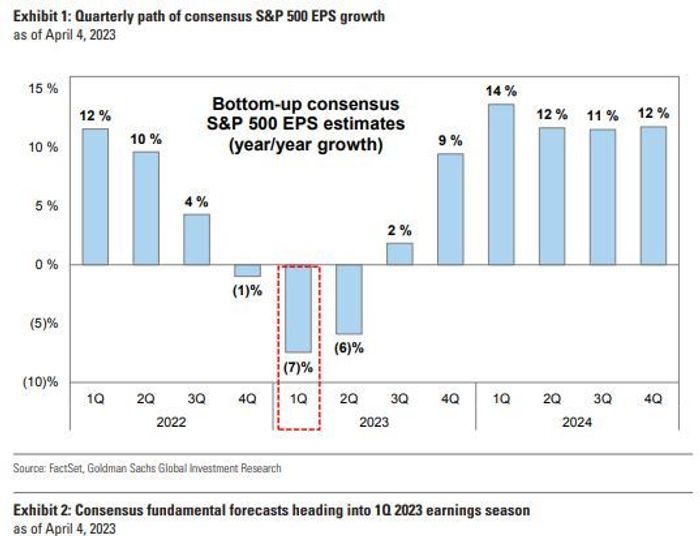

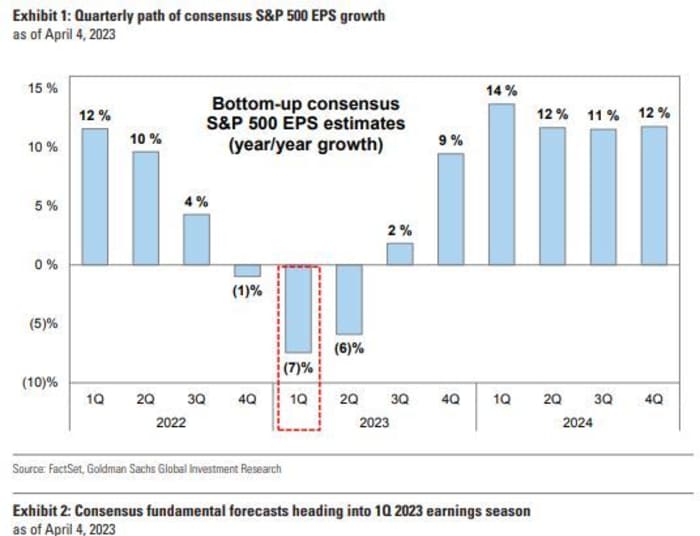

The outlook for corporate profits during the first quarter is looking pretty gloomy.

But a team of analysts at Goldman Sachs Group see hope for individual companies that could manage to buck the trend by delivering on four areas of critical importance to investors.

Analysts cut their outlook pretty aggressively as the economic outlook deteriorated during the first quarter. As a result, operating profits are expected to have shrunk by 6.8% last quarter, according to an average of Wall Street forecasts compiled by FactSet.

GOLDMAN SACHS

If this comes to pass, it would mark the worst quarterly contraction since the third quarter of 2020, when corporate profits cratered by more than 30% as COVID-19-inspired lockdowns rocked the global economy.

Other equity analysts are devising strategies that could help investors protect their portfolios if a flood of dour corporate results sends U.S. stocks into a tailspin.

Profit margins will be key

Corporate profit margins are being squeezed by the worst bout of inflation in four decades. Last quarter, margins for S&P 500 firms retreated by 11.2% at the index level, surpassing expectations for an 11.1% drop.

Because of this, companies that have a credible plan for protecting their margins should expect to be rewarded by investors, according to the Goldman team, led by David Kostin, the bank’s chief U.S. equity strategist.

“With margins projected to contract by a greater amount than in any other quarter since the pandemic, investors will focus on which companies manage to preserve margins and by what means,” the team said.

Strategies for improving pricing power, enacting cost cuts or imposing more disciplined expense-management will likely be rewarded.

Are companies using AI to cut costs and improve efficiency?

The rise of ChatGPT has helped make artificial intelligence one of the most closely followed investment trends of 2023, according to MarketWatch’s James Rogers.

Perceived dominance in the AI space has helped fuel a market-leading rally in megacap tech names like Microsoft Corp.

MSFT,

Google parent Alphabet Inc.

GOOG,

and chip maker Nvidia Corp.

NVDA,

that has helped mask weakness in other corners of the market while pushing the Nasdaq-100 back into bull-market territory.

So it probably shouldn’t come as a surprise that companies might be able to paper over weakness in profits and sales with a convincing pitch about how they plan to use AI to their advantage — especially if it helps boost profit margins by making their workforce more efficient, the Goldman team said.

“One new potential boon to margins could be the gradual adoption of generative artificial intelligence by companies to automate manual tasks and boost labor efficiency,” they said.

Belt-tightening will remain in focus

Signs that corporations are cutting back on spending are beginning to materialize, the Goldman team said.

Share buybacks via Goldman’s buyback desk declined by more than 20% compared with 2021 during the fourth quarter, and activity has remained weak, the analysts said. What’s more, several leading economic indicators suggest companies are paring back spending on capital projects and research and development.

So expect investors to pay close attention to any and all signs of belt-tightening during quarterly reports and the ensuing analyst calls with top executives.

Is China’s reopening making a difference?

Chinese officials including President Xi Jinping have promised a powerful reopening. Amid signs of slowdown in the all-important U.S. services sector, as well as in other parts of the economy, companies could look to China for a boost.

“We expect investors will keep their ears perked for discussion around how much this has boosted earnings,” the team said.

Strategies for protecting your portfolio

Highflying megacap tech names have been keeping indexes like the S&P 500 aloft, while value-oriented names have lagged the broader market after outperforming during 2022.

Technically, when corporate earnings shrink for two quarters in a row, it qualifies as an “earnings recession.” But while an earnings recession typically coincides with a broader economic recession, it doesn’t always have to be that way, according to Ed Yardeni, president of Yardeni Research.

Historically, S&P 500

SPX,

firms’ reported earnings per share have always fallen during economic recessions, according to quarterly data compiled by Standard & Poor’s that was cited by Yardeni.

“It might be different this time, however: earnings could fall without an economywide recession,” he said.

But regardless of what happens with the broader economy, some expect weak corporate earnings could drive the S&P 500 back toward its lows from October, when it closed below 3,600.

Phil Orlando, chief equity market strategist at Federated Hermes, is one of them.

“We continue to advocate a tactical defensive investment posture, with a focus on less-expensive value, small-cap and international stocks and sectors with lower betas and higher dividend-yield support. We also still like cash and Treasurys,” he said in emailed commentary shared with MarketWatch.