The economy has been through a lot over the past couple of years. We turned it off and turned it back on again like we were restarting a video game.

A combination of fiscal stimulus and supply chain disruptions led to an inflationary spike not seen in over four decades. All the containers stuck in the ports of Los Angeles wreaked havoc on many consumer-facing companies. Semiconductors were in short supply. Used car prices went through the roof.

Amidst all of the chaos, Russia invaded Ukraine, which sent energy and commodity prices vertical. To slow all of this down the Federal Reserve undertook a historic increase in interest rates; basically straight up for the last year and counting. That caused the housing market, at least the existing one, to all but freeze over. It also caused several financial institutions to mismanage their interest rate risk and led to some of the biggest bank runs this country has ever seen.

Rising interest rates destroyed any appetite for risk-taking, with tech being at the epicenter of the enthusiasm unwind. Venture funding dried up, IPOs ground to a halt, and even mega-cap tech companies were forced to do mass layoffs. Along the way, the S&P 500 fell 25%, and the Nasdaq-100 lost more than a third of its value.

The $3 trillion office real estate market is going to experience some pain over the next few years with occupancies down and borrowing costs up. And the cherry on top of this disgusting sundae is the looming contraction in credit.

How much can we take?

I don’t know where the tipping point is, but the apparent answer to this question is a lot more than anyone thought. Things aren’t perfect, but we recovered all the jobs lost during the pandemic, the unemployment rate is still near record lows, and inflation is going in the right direction.

And this week we heard from banks that the consumer is still okay. We won’t learn the full impact of the bank run until next quarter, but regardless of that, it’s incredible that Americans have been so resilient given all the headwinds mentioned above. Even had we not seen the bank runs, there still would have been questions about the durability of consumer spending. We got answers in recent earnings calls from companies like Bank of America and American Express.

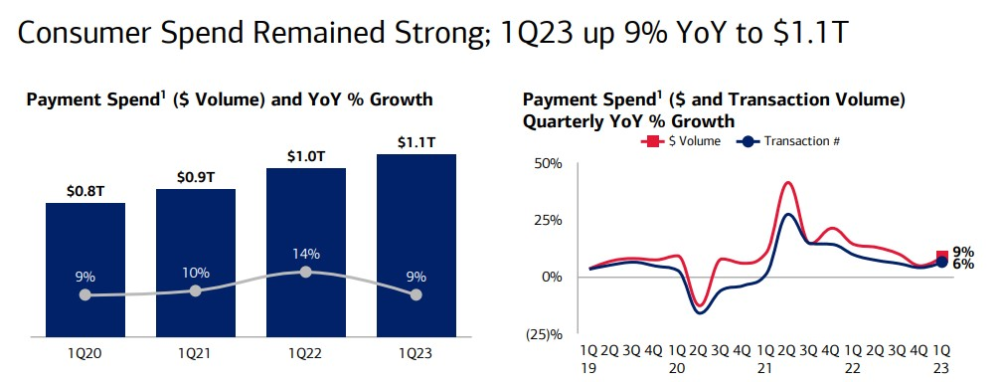

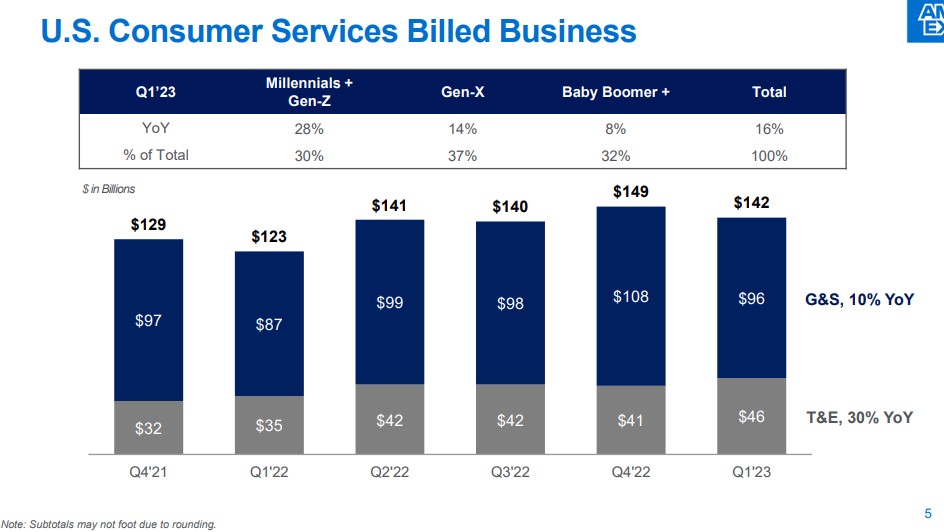

Bank of America saw a credit card loss rate of 2.21% in the first quarter, up from 1.7% in the fourth quarter but down from 3.03% in Q4 2019. Consumer spending is up 9% y/o/y, and most, but not all of it was driven by higher prices, with transactions up 6% over the same time.

Given the spending surge when the economy reopened, given inflation, and given higher interest rates, you would surely have expected this number to go negative at this point. Maybe we get there next quarter, or maybe we don’t, but either way, the resilience here is super impressive.

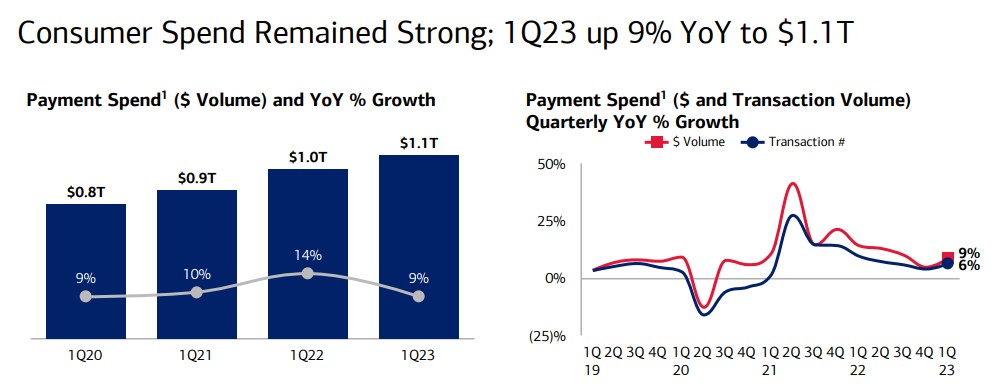

American Express also showed that credit card losses are rising, but still well below pre-pandemic levels.

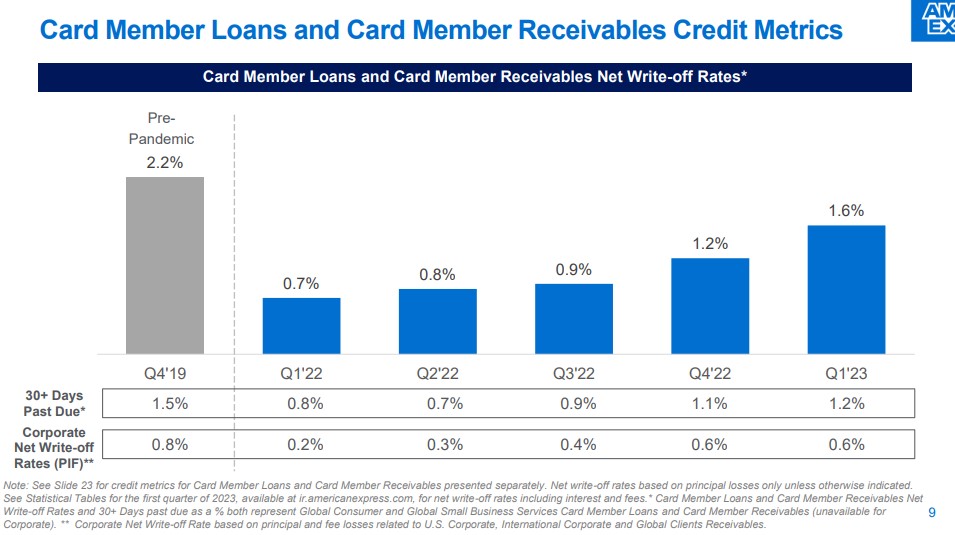

Amex reported a record high in revenue for the quarter, with the majority of it coming from younger people:

“We acquired 3.4 million new cards during the quarter…Demand from Millennial and Gen Z consumers continues to fuel this growth, accounting for more than 60 percent of all new consumer account acquisitions in the quarter. Millennial and Gen Z customers also continued to be our fastest-growing U.S. cohort in terms of spending, growing 28 percent from a year earlier.”

When you put it all together, it really is incredible how much we’ve been through over the past few years. And the fact that we’ve managed to get this far without the wheels completely falling off says something about our economy that I don’t think should be discounted. We are resilient. We can take a punch. We keep going.

There are plenty of reasons to be concerned going forward, but I wanted to take a breather from what the future might hold to reflect on what we just went through.